Quickbooks paycheck calculator

Sales 800-267-5519 Mon-Fri 6AM to 6 PM Pacific Time Support We provide multiple support options so you can get assistance when you need it. This field type allows the user to type anything.

New Feature For Quickbooks Desktop Employee Pay Adjustment History Report

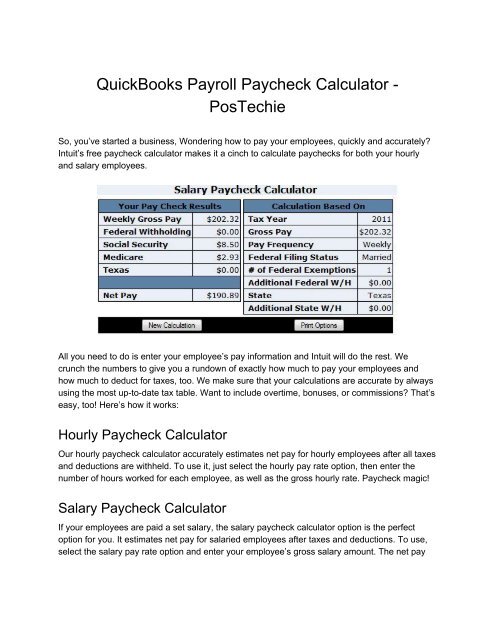

Paycheck Calculator Looking to pay your employees quickly and accurately.

. QuickBooks Payroll is only accessible via QuickBooks Online subscriptions. This is the amount of the paycheck or direct deposit that an employee takes home after all deductions contributions and taxes. The official title of a W-4 is Employees Withholding Certificate and it tells employers how much tax to hold back or withhold from each paycheck for federal taxes.

We make sure the calculations are accurate by using the most up-to-date tax table. Employers use the W-4 to help determine payroll taxes and to withhold taxes for both the Internal Revenue Service IRS and state if income taxes are applicable on. Locations also found in QuickBooks Online Plus and Advanced allow you to examine the financial resources behind transactions.

Youre also limited to 40 classes in QuickBooks Online Plus. Enter your employees pay information and well do the rest. QuickBooks Desktop Enhanced Payroll for Accountants will not be impacted by this price increase.

Automated tax and forms Federal and state payroll taxes including year-end filings. Then enter the employees gross salary amount. Common information such as the employees and employers names should be included.

Easily calculate your tax rate to make smart financial decisions Get started. Unfortunately that freedom also causes reporting errors caused by. QuickBooks desktop payroll services including Assisted Basic Standard Enhanced Workers Comp Payment Service and QuickBooks Workforce formerly View My Paycheck.

Below find 27 accounts that offer this service and an explanation of how they can do it. What are the QuickBooks Desktop price increases. If you make 55000 a year living in the region of Florida USA you will be taxed 9076That means that your net pay will be 45925 per year or 3827 per month.

These boxes on the W-2 provide all the identifying information related to you and your employer. Some employers use Incentive Stock Options ISOs as a way to attract and retain employees. Heres a roundup of the highest and lowest taxes by state.

Classes are also not good for time-based categories such as an event because theyre meant to be permanent. You will be charged 500 incl. Congress passed the Paycheck Protection Program PPP loan as part of the Coronavirus Aid Relief and Economic Security CARES Act to provide fast and direct economic assistance for small businesses and to preserve jobs for Americans.

Go here to get support for Payroll for QuickBooks Online. You can also use the same tool to calculate hypothetical changes such as withholding more money from each paycheck or increasing your retirement contributions. Youll see your social security number Box A name Box E and address Box F appear here while your employers employer identification number EIN Box B name and address Box C and control number Box D if any appear here as well.

Benefits of Using a Payroll Calculator. QuickBooks Desktop Enhanced and Basic Payroll subscriptions that have a monthly per-employee fee will see the following price changes on or after Oct. These features will be affected on May 31 for 2020 QuickBooks Pro Premier and Enterprise Solutions.

You will want to prepare new W-4s for all your jobs following the instructions or use the IRS online calculator. Can the net harness a bunch of volunteers to help bring books in the public domain to life through podcasting. Then enter the employees gross salary amount.

Exempt means the employee does not receive overtime pay. 1 Text Number field. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

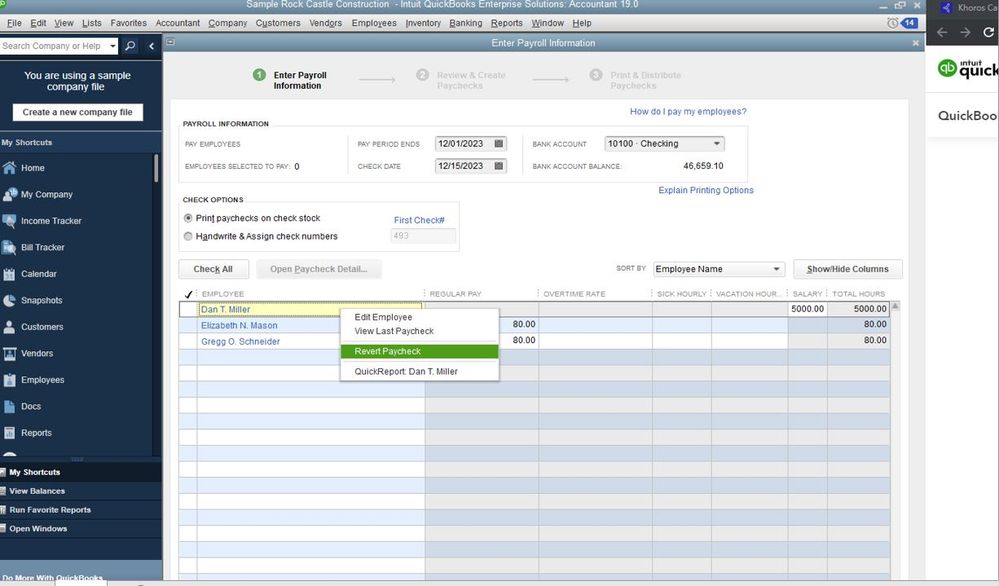

Exempt means the employee does not receive overtime pay. The improved Batch Enter Transactions feature in QuickBooks Accountant 2014 is designed for accounting professionals who want to work more efficiently and profitably when providing write-up services for their clients. Explore our checking savings accounts and lending services today.

Well monitor and update federal and state taxes so you dont have to. Middlesex Savings Bank offers a variety of services for Massachusetts businesses. Know how much to withhold from your paycheck to get a bigger refund Get started.

Weighing the tax landscape against your financial picture lets you stretch your dollars. It also is good for companies using QuickBooks Enterprise Solutions 140 and want to quickly add data to their QuickBooks file. Well help you understand ISOs and fill you in on important timetables that affect your tax liability so you can optimize the.

GST per month for each active employee paid using QuickBooks Payroll. LibriVox is a hope an experiment and a question. Your average tax rate is 165 and your marginal tax rate is 297This marginal tax rate means that your immediate additional income will be taxed at this rate.

Where you live can help or hinder your ability to make ends meet. Intuits free paycheck calculator makes it a cinch to calculate paychecks for both your hourly and salary employees. Early direct deposit can effectively get your paycheck into your checking account up to two days early.

Additional components of employee pay stubs. Estimate your self-employment tax and eliminate any surprises Get started. You should also include the pay period dates and the paycheck issue date.

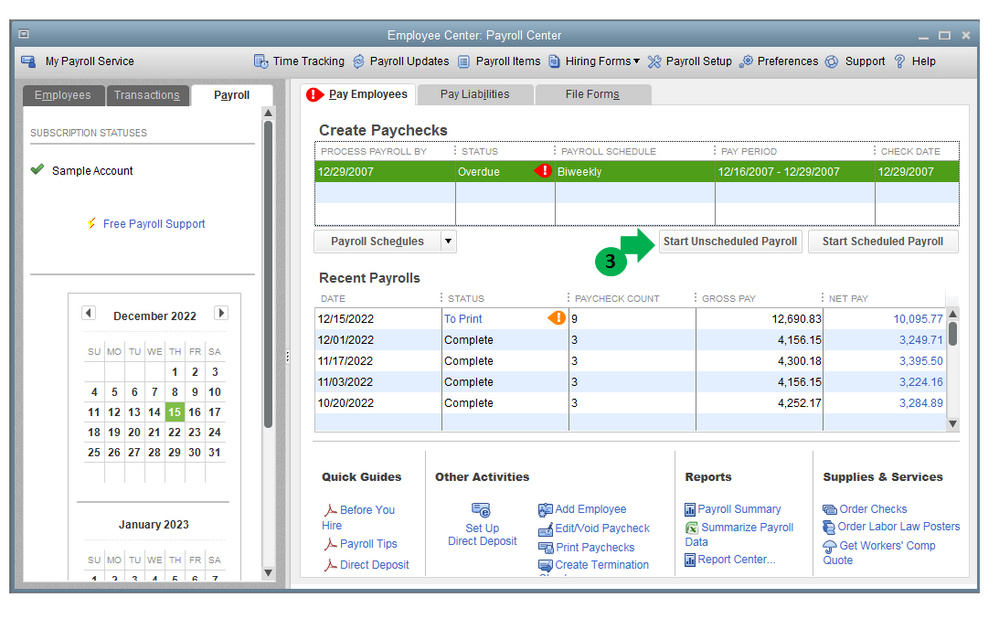

Calculate paychecks and taxes Get automatic tax calculations on every paycheck. This loan has allowed many small businesses to stay afloat during the sudden economic recession in 2020 and its. What features will be affected as of the QuickBooks Sunset date.

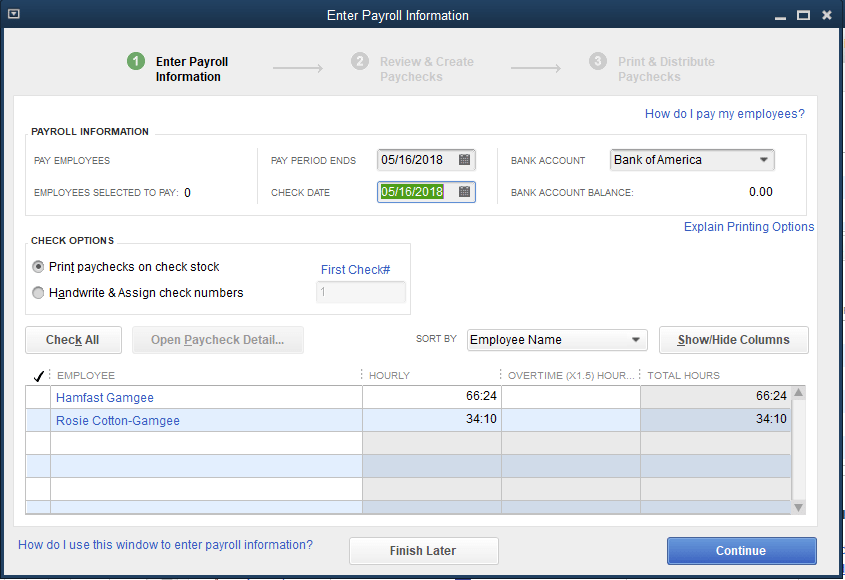

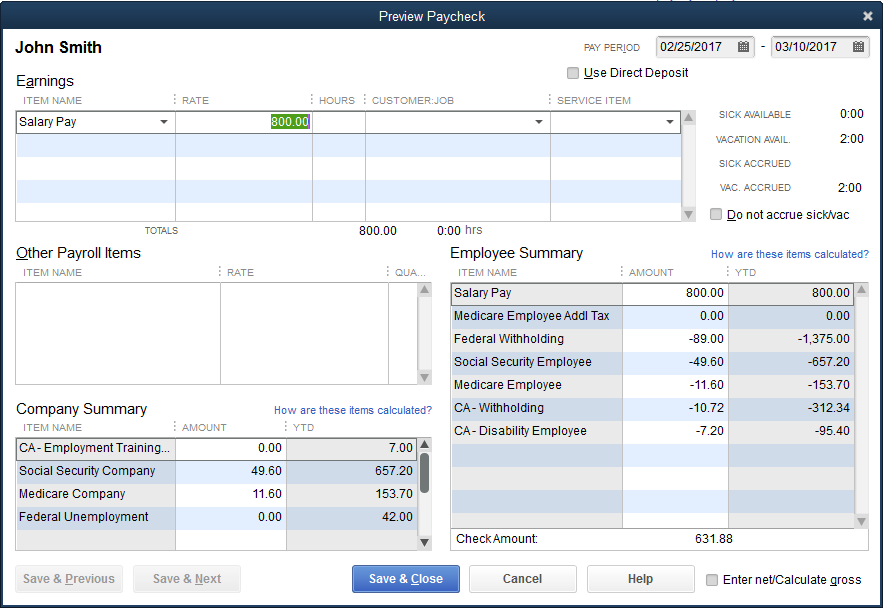

QuickBooks Payroll powered by KeyPay. Payroll services are offered by a third-party Webscale Pty Ltd the makers of KeyPay. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option.

Fast unlimited payroll runs QuickBooks Online Payroll lets you view and approve employee hours and run payroll in less than 5 minutes. A myriad of taxesproperty license state and local sales property inheritance estate and excise taxes on gasolineeat away at your disposable income. While ISOs can offer a valuable opportunity to participate in your companys growth and profits there are tax implications you should be aware of.

QuickBooks QB TurboTax. Intuit Payroll for QuickBooks Online. Since the introduction of the custom fields into QuickBooks Online the text field has been the standard field available for everyone to use.

There are many benefits of using a payroll calculator including the ability to estimate your paycheck in advance. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Generally you only list your children on the job with highest income look carefully at step 3 of the form also make sure you either use the online calculator or check the box for married with 2 jobs in step 2.

The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

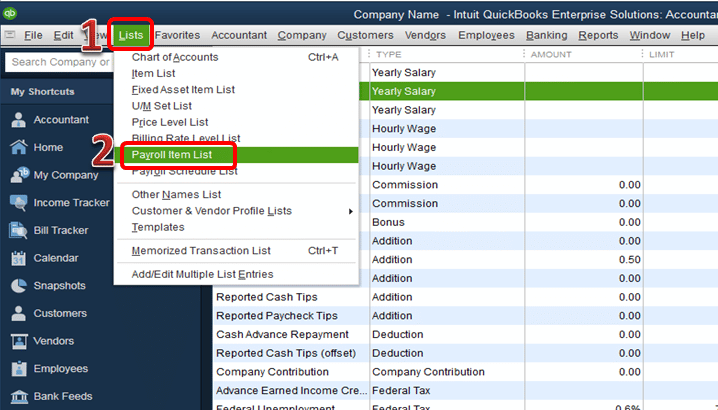

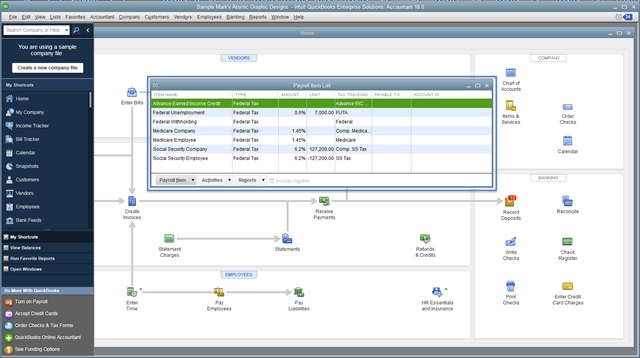

Solved Payroll Taxes Not Deducted Suddenly

Solved Payroll Taxes Not Deducted Suddenly

Solved Payroll Taxes Not Deducted Suddenly

Solved Other Payroll Items Not Calculating User Defined Payroll Item

Learn How To Do Payroll In Quickbooks Online And Desktop

Manually Enter Payroll Paychecks In Quickbooks Online

One Day Processing Now Available For Quickbooks Payroll

Quickbooks Paycheck Calculator Intuit Paycheck Calculator

Intuit Quickbooks Payroll Paycheck Calculator Postechie For Quickbooks

Desktop Payroll Taxes Suddenly Not Deducted

Manual Payroll In Quickbooks Desktop Us For Job Costing Youtube

Solved How To Fix Payroll Error In Quickbooks Desktop

Solved How To Fix Payroll Error In Quickbooks Desktop

Fix Quickbooks Payroll Taxes Are Calculating Incorrectly Solved

Quickbooks Payroll Is Not Taking Out Calculating Taxes Fixed

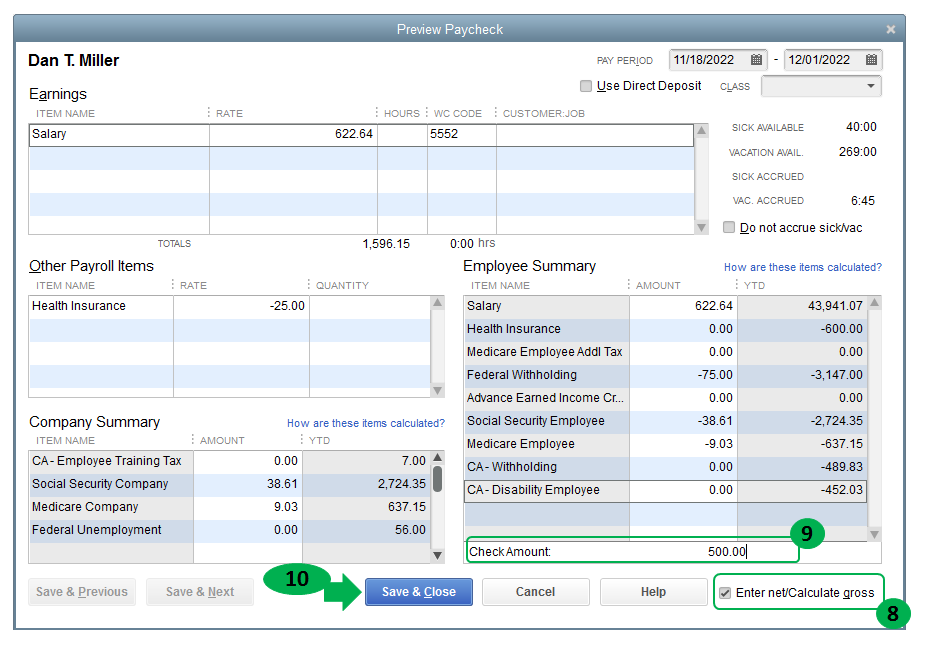

Pay A Partial Or Prorated Salary Amount In Quickbooks Desktop Payroll

How Do I Manually Enter Payroll In Quickbooks 1 855 875 1223